After running a broad screen to reduce the number of initial contenders, we put six companies through the Dividend Compass spreadsheet to get a better feel for the health of the companies' dividends.

Of course, all of that work was based on historical data. Today, we'll dig deeper into the two finalists -- MTS Systems and WD-40 Company -- to determine how those names might perform going forward. Further, the research we've already done shows that both companies have solid balance sheets, are consistent generators of free cash flow, and have established good dividend track records. As such, we won't spend too much time digging into those data points today.

Instead, we'll look at the two companies' competitive advantages (if they indeed exist), management quality, and consider their current valuations to determine whether or not they're worthy of investment right now.

The finish line is in sight

After digging into WD-40 and MTS this week, it's clear that the screening and Dividend Compass process uncovered two promising companies. Indeed, they check off a number of Peter Lynch's 13 signs of a perfect stock. Among them: little analyst coverage (officially, MTSC has two analysts, WDFC has four analysts), they each have a niche, and the companies are buying back stock (though this isn't always a great thing, in my opinion).

As with most endeavors, the hardest part of the investing process is the last stretch. Most investors go through the screening process and read historical financial statements. Where you can separate yourself as an investor is in this last stretch of research -- digging for the qualitative factors and getting a feel for valuation.

MTS Systems (MTSC)

What does the company do?

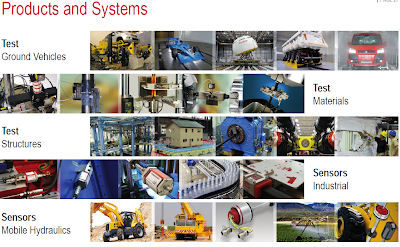

MTS Systems supplies test systems and industrial sensors to a number of end-markets such as the automotive, aerospace, fluid power, and manufacturing sectors (i.e. mostly cyclical industries). About 80% of revenue comes from the test segment, which designs force and motion systems for determining a new product's mechanical properties; MTS commands a 16% market share of the global testing product and service industry. The sensors segment helps customers improve the efficiency and safety of their automated manufacturing processes and also measures fluid displacement and liquid levels; MTS has a 6% share of the global sensors market.

|

| Source: MTS |

MTS also has a wide geographical reach, with an established presence in the world's major manufacturing centers.

|

| Source: MTS |

Does it have sustainable competitive advantages?

Historical financials seem to suggest that MTS has a sustainable competitive advantage. It may lie in the "mission critical" nature of its products. Firms investing many millions of dollars in large industrial products simply cannot afford to forgo strenuous mechanical and fatigue testing before rolling the new product out to customers. The warranty or recall risk from a flawed piece of equipment may well outweigh the testing cost. Further, some products may be required to undergo such testing due to government regulation. But these could simply be industry-level advantages rather than a specific advantage to the firm.

Where MTS may set itself apart is with its established brand and reputation in the industry for doing quality testing, particularly for larger-scale projects. I'd imagine that most smaller-scale product testing can be done internally and that the competition for smaller-scale projects is pretty fierce. Larger-scale testing projects can last up to three years, however, and there are probably only a few companies that can handle such work -- MTS being one of them -- and customers are unlikely to switch providers halfway through the testing period. As such, I'd say MTS has a slight advantage stemming from switching costs for larger projects, but the depth of the moat will fluctuate along with demand for these larger-scale projects.

How about management?

The MTS leadership team is relatively new, by which I mean less than two years in their roles. It seems a few years ago that the company got in a little trouble regarding some disclosure items relating to government contracts. This appears to have been one of the primary drivers behind the August 2011 resignation of the former CEO and the re-shuffling of the executive suite. Such dramatic moves are necessary when there's been an ethics issue, but it also likely means that the company will be in transition mode for a few years. Unless you know a lot about the new management team (I don't) and the effect the changes are having at the ground level (again, I don't), it's hard to make a bold turnaround call (so I won't).

Short-term cash bonus metrics are based on EPS, EBIT, revenue, and orders. Not my favorite set of metrics, but not terrible given that MTS remains squarely in the growth stage of its lifecycle. In time, I'd prefer to see less emphasis on top-line growth and more emphasis on free cash flow and profit growth.

Biggest concern?

With 40% of testing orders coming from Asia, I have some concerns regarding the Chinese economy -- specifically, how the shift from an investment- and manufacturing-driven economy to a customer-driven one may affect demand for MTS's testing services in the region. MTS aims to double its revenue to $1 billion by 2018 and robust demand from the Chinese market will likely be necessary to achieve that goal.

Is it a good buy today?

MTS's average return on equity over the last five years is about 18% and its dividend policy is to pay out approximately 30% of earnings, implying a back-of-the-envelope sustainable growth rate of between 12-13%. Not bad against a P/E ratio of 18.6 times (~1.5 PEG), but not a slam dunk, either.

Doing some DCF work on MTS with a range of reasonable growth assumptions, I'd put a base case fair value near $60 per share, which is in-line with today's market price. I'd need a margin-of-safety of at least 20% with this type of business, so a good entry point might be closer to $48.

MTS is definitely a good one to watch in the event of a market pullback and there's significant dividend growth potential, but given my uncertainty around its sustainable competitive advantages and a newer management team, I wouldn't make it more than 2% of my portfolio.

WD-40 Company (WDFC)

What does the company do?

Anyone who's spent time in a garage, fixing squeaky hinges around the house, or worked on bicycles has likely used a WD-40 product. In fact, the vast majority of the company's revenues are based on the original WD-40 formula (WD-40 stands for “Water Displacement perfected on the 40th try”) and the company's documented over 2,000 uses for the secret formula. The company also owns a number of related consumer/industrial cleaning products such as Lava soap and X-14 mildew stain remover. Its products are sold in 187 countries, so the company does have a wide geographic reach (about 40% of sales are U.S.-based).

Does it have sustainable competitive advantages?

For starters, the WD-40 brand name is extremely valuable. I can't even name a substitute product. It's a trusted brand, can charge a premium price, and I'd even argue that there's a slight emotional connection to the brand (i.e. "this is the brand that my dad always used in the garage"). Beyond the brand, the company's ability to build upon a single secret formula and create multiple products is an example of economies of scope. This results in a cost advantage that would-be competitors would struggle to match if they attempted to go head-to-head with WD-40 on a certain product line.

|

| Source: WD-40 |

The company's ability to consistently generate double-digit returns on capital is another indication that an economic moat is likely present. Finally, another telling statistic: in 2012, WD-40 generated nearly $1 million in revenue per employee. I like to see at least $250,000 in revenue per employee, so this is definitely a sign of a strong company.

How about management?

One thing that I really like about WD-40's management team is that all seven corporate officers been with the company for more than 15 years. My personal preference is for the companies I own to promote from within and to have a deep bench of talent in the event an executive leaves or retires. This is particularly true for a company with a strong corporate culture, as it supports cultural continuity. Now, a company with a rotten corporate culture may need to hire an outsider to shake things up, but all else equal I prefer internal promotion in the executive suite.

CEO Garry Ridge has been with the firm since 1987 and the CEO since 1997. During his tenure, the stock is up 319% cumulative, or about 9.2% annualized, compared to a 200% gain, or 6.9% annualized, for the S&P 500 over the period. The stock's also outperformed the S&P 500 by about 40 percentage points over the last five years. All this is to say that long-term shareholders should be fairly happy with the way the company's performed under Ridge's leadership. WD-40 also keeps the chairman position separate from the CEO role, which is textbook best practice for corporate governance.

I'm not crazy about management's bonus incentives, which are primarily linked to EBITDA. EBITDA is one of my least favorite financial metrics (Buffett called trumpeting EBITDA a "pernicious practice" in the 2002 letter; Munger called it "(expletive) earnings") because interest, taxes, and depreciation are natural and recurring shareholder expenses that shouldn't be ignored. I could rant on about EBITDA, but I'd much prefer this otherwise high quality company to use more shareholder-focused incentive metrics such as net income, free cash flow, and/or economic value added (EVA).

Biggest concern?

A potentially limited growth runway. With its products already in 187 countries and a sizeable portfolio of products already built around the WD-40 brand, what will drive top-line growth in the medium-term? I have no doubt that consumers will continue to buy WD-40, but can the company deliver high-single digit/low-double digit earnings growth without becoming more active on the M&A front?

Is it a good buy today?

WD-40's consistency and high quality hasn't been overlooked by the market and the stock has historically traded at a premium. WD-40's five-year average P/E is 19.1 times versus 17.2 times for the S&P; today it's trading at 22.7 times. Not exactly cheap on that basis. But what about growth? Based on the company's five-year average return on equity near 19% and its dividend payout ratio near 50%, the "sustainable growth rate" is about 9-10%. An implied PEG ratio near 2x isn't great, either. Its current dividend yield of 2.1% is also well-below its five year average closer to 3%.

Running a quick valuation on WD-40, I put a fair value on the shares at $52 (currently $58.52). I'd look to buy with at least a 15% margin-of-safety, so a good buy-around price today would be $44.

I really like WD-40 as a company. Hopefully the EBITDA-based incentive metrics go away, but otherwise I'd be happy to own WD-40 in the event of a market pullback. Ideally, I'd like to pick up the stock with a yield closer to 3%, which is about what I'd get if the stock traded near $44.

Bottom line

MTS Systems and WD-40 are both intriguing dividend growth candidates, but neither appears to be a good value at the moment. MTS has more dividend growth potential than WD-40, but also carries more risk.

All in all, I think this was a worthwhile exercise. We dug into two promising dividend growth opportunities and now have two good names to keep on our watchlists.

What do you think? Please let me know in the comments section below. Note: I switched the comments format back to the normal setting as the Google+ format was simply not working well. You can also reach me @toddwenning on Twitter.

Other posts in this series:

How to Find a Good Dividend Growth Stock: Part 3

Thanks as always,

Todd

@toddwenning